Namely Toolkit: Tax Services

This toolkit contains all of the information you need to handle tax collection, filing, and remittance in Namely. Learn how to register for state taxes and power of attorney, and what to do with tax notices and variances.

Welcome to the Namely Tax Toolkit!

If you're a client with our core offering, this Toolkit will walk you through each step of tax configuration for your company and employees. Whether you're setting up taxes for the very first time or have an employee living or working in a new state, following these steps will help ensure your taxes are set up properly in Namely. Then, we collect and remit payments to tax agencies when you process payroll.

If you’re a managed payroll client, please reach out to your Payroll Consultant for tax registration next steps.

Read on to get started!

GETTING STARTED

LEARN WHAT'S REQUIRED TO SET UP YOUR TAXES.

Each state where your company operates and where you have employees living and working has taxes that need to be paid by your company and/or employees. In order for Namely to make tax filings and collect and remit payments to the appropriate tax agencies on your behalf, you'll need to complete the following steps, which we'll walk you through in detail as you continue in this Toolkit:

Register for tax IDs with all applicable jurisdictions.

Enter Tax IDs and UI Tax Rates into Namely Payroll.

Set up your individual employees' taxes in Namely Payroll.

Regularly audit your payroll data and resolve issues.

As you continue through this guide, you'll encounter many common industry and Namely-specific terms about Payroll. This article on Namely Payroll Terminology can help define these terms if you have questions.

Let's begin!

REGISTERING FOR TAX IDS

HOW TO REGISTER WITH THE PROPER JURISDICTIONS.

Taxes are a big deal—and we're here to help make sure you get it right.

In order for your company to avoid any potential penalties and interest, you should complete the registration steps below as soon as you know that:

-

You'll have an employee working in a new state, or

-

Your company will be opening up shop in a new state

It's important to note that tax registration is your responsibility—Namely does not register for taxes on behalf of clients unless we have been contracted to do so. If you need help registering for tax IDs, check out our Tax Registration Services Overview to learn how our team can register for an ID on your behalf.

Ready to dive into tax registration? Read on to learn how.

CHECKLIST

YOUR TAX REGISTRATION TO-DOS.

On the state level, tax registration typically includes:

Applying for Unemployment Insurance with your state's Department of Labor

Applying for Tax Withholding with your state's Division of Revenue

Completing the Power of Attorney package may also be necessary in order for Namely to communicate with State Tax Agencies on your behalf.

For detailed information on the responsibilities that employers, tax jurisdictions, and Namely have throughout the tax registration process, see our complete Employment Tax Registration Overview guide.

STATE-SPECIFIC GUIDELINES

DETAILED REQUIREMENTS FOR EACH STATE.

While the overall process of registering for tax IDs is similar from state to state, individual states have a number of unique requirements. To help simplify the registration process, we've compiled a set of State Tax Guides that contain detailed information on the jurisdictions you need to register with.

Click on the state below to learn how to register for required taxes and access state-specific Power of Attorney forms, tax withholding information, and more.

ONCE YOU'VE APPLIED FOR IDS

WHAT TO DO IF YOU'RE WAITING TO RECEIVE TAX IDS.

Wondering whether you can pay employees in jurisdictions from which you don't yet have IDs? You can! In these cases we allow you to note that the required tax ID has been “applied for” when setting up taxes in Namely by:

-

Navigating to Payroll > Company > Tax > Add Tax.

-

Selecting the Waiting for Tax ID option.

Until you enter an ID, these taxes will remain in "applied for" status. Note that Namely cannot collect taxes until you enter a valid tax ID.

Additionally, if tax IDs are still in "Applied for" status at the quarter close, Namely cannot file taxes for those jurisdictions at that time.

Payroll administrators should keep track of all pending state IDs they have applied for—along with the IDs' respective registration statuses. Review Namely Payroll to ensure that each state has either Tax IDs entered or is currently within the application process.

To locate missing tax IDs within Namely Payroll, administrators can navigate to Company > Tax and review the Tax ID field. Any taxes that list Applied For still need to be filled in with the proper tax ID. Additionally, if you attempt to run payroll with incomplete tax information on your Company Tax page, we'll alert you.

Once you've received your IDs, continue to the next step.

ENTERING TAX IDS INTO PAYROLL

HOW TO INPUT INFORMATION ON STATE AND LOCAL TAXES.

As soon as you've received tax IDs, entering relevant tax information in Namely is necessary in order for us to collect and remit payments to tax agencies when you process payroll.

Remember, Namely cannot make payroll tax payments or filings on your behalf if we aren't provided with all the required information. If we are missing information, you will be responsible for penalties and interest due to late payments or filing. For this reason, it's important that you enter tax IDs into Company > Tax as soon as you receive them.

Ready to enter tax IDs? Read on to learn how.

CHECKLIST

YOUR COMPANY TAX TO-DOS.

Typically, when you receive tax IDs the tax jurisdiction will provide you with a Tax ID and Tax Rate. As soon as you receive tax IDs:

Navigate in Namely to Company > Tax and click Edit next to the tax.

Enter your ID, rate, and pay frequency on the screen that follows.

For detailed instructions, see Adding and Editing Company Tax Codes and Rates in Namely Payroll.

Understanding Pay Frequency versus Filing Frequency can also help you avoid tax notices, penalties, and interest that could result from using an incorrect frequency. Using aggressive pay frequencies when pay frequencies are unknown for a tax jurisdiction can also help prevent tax notices.

ONCE YOU'VE ENTERED IDS

HOW TO ENSURE TAXES ARE COLLECTED.

Once you enter a new tax ID, Namely will automatically collect previously uncollected amounts from the current quarter and onward on your next standard pay cycle. For more information see Automatic Tax Collection for “Applied For” Tax IDs.

Note that Namely does not automatically backfile for any missed quarters after new tax IDs are provided without your specific request. To request that Namely backfile on your behalf, submit a case in the Help Community by selecting Payroll > Taxes > Tax Services > Function = Applied for Recollection.

Also be aware that certain situations may require you to wire funds to Namely once tax IDs are entered, including:

-

Uncollected amounts remain from previous quarters

-

No scheduled pay cycles are left in the current quarter when you enter a new tax ID

NEED-TO-KNOW INFORMATION

OTHER IMPORTANT RESOURCES YOU'LL NEED.

Be sure to familiarize yourself with this additional important information to ensure your company taxes are set up correctly.

-

Taxes Namely Does Not Collect and Remit catalogs a list of taxes that you're responsible for collecting and remitting.

-

Namely's Federal and State: Payroll and Tax Fact Sheet provides the most recent information about federal and state taxes.

-

Namely Payroll User Administrative Roles outlines the different types of access permissions for Users in Namely Payroll, helping you ensure that employees who will be handling your tax configuration have the necessary permissions.

SETTING UP EMPLOYEE TAXES

HOW TO ADD AND EDIT TAX INFORMATION FOR YOUR EMPLOYEES.

In addition to adding your company tax information, you'll need to make sure your employees' taxes are set up correctly.

Ready to add employee tax information? Read on to learn how.

CHECKLIST

YOUR EMPLOYEE TAX TO-DOS.

To make sure your employees' taxes are set up correctly there are two major steps:

Take advantage of feature and send employees their tax forms via e-Signature

Set up the employee tax page in Namely Payroll

TAX WITHHOLDING UNIFICATION

AUTOMATICALLY TRANSFER TAX INFORMATION TO EMPLOYEES' PAYROLL PROFILES.

Tax Withholding Unification is a Namely feature that automatically populates tax withholding information submitted via eSignature—either during onboarding or at a later date—on an employee’s payroll profile. The feature utilizes both federal and state tax forms and streamlines data entry for payroll administrators

In order to take advantage of Tax Withholding Unification, you must:

-

Have Adobe eSignature integrated with your Namely site, and

-

Use only Namely-provided withholding forms in your onboarding templates

Namely keeps our library of withholding forms up to date and the newest forms are available for your use within a few days of their release.

For detailed instructions, see Updating Tax Withholding via eSignature. Additional information and answers to frequently asked questions about our Tax Withholding Unification feature are available in Tax Withholding Unification FAQs.

COMPLETING THE EMPLOYEE TAX PAGE

IMPORTANT INFORMATION YOU'LL NEED TO ENTER MANUALLY.

The Employee Tax page contains information on the employee's state, federal, and local tax withholdings, home and work locations, filing status, and more. When adding tax information for a new employee, the Employee Tax Page is where you'll need to add the following information:

-

The employee's work location, and

-

Tax type

It's important to note that employees cannot enter their W-4 information in Namely Payroll themselves—only admins can enter and edit tax information for employees in Namely Payroll.

If you have not yet added a new employee’s tax information, you can access their tax page by:

-

Clicking Payroll Tax under Missing Fields on the Profile Status page, or

-

Navigating to Employee > Search in Payroll, using the search function to find the employee’s profile, and clicking Tax

For detailed instructions, see Adding and Editing Employee Tax Information. Note that if your company does not use Tax Withholding Unification, you'll also need to enter additional information manually on the employee tax page.

For information on dual-state taxation, see Enabling Dual-State Taxation for Existing Employees. For detailed instructions on how to exclude live-in locations for employees whose home state is different from their work-in state, see Excluding Live-In State Tax for Existing Employees.

PREVENTING TAX ISSUES

HOW TO KEEP YOUR ORGANIZATION IN COMPLIANCE.

While the potential for tax issues can be stressful, it's important to remember that most tax issues can be avoided by following the guidelines above—including registering for new taxes as soon as you know you have an employee in a new state.

To help you avoid future tax issues, we've also compiled a collection of additional best practices and resources to help you make sure your organization is in compliance. And remember—if tax issues arise, we're here to help you navigate them with the guidance below.

Ready to address tax issues? Read on to learn how.

CHECKLIST

YOUR DAY-TO-DAY COMPLIANCE TO-DOS.

These steps will help your organization avoid potential tax issues and show you handle tax issues properly if they arise:

-

Regularly audit your payroll data

-

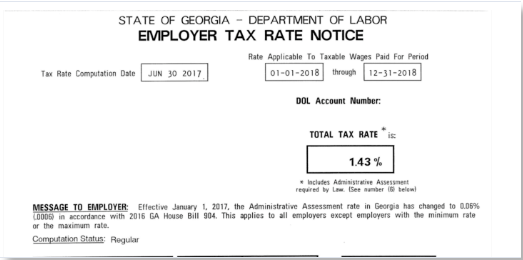

Update tax rates as soon as you receive rate change notices

-

Empower employees to update their information

-

Resolve any tax notices and tax variances

-

Consult our troubleshooting resources

REGULARLY AUDIT PAYROLL DATA

PERFORM FREQUENT PAYROLL CHECKUPS.

These articles contain our recommended best practices for auditing your payroll data, which can prevent tax notices, variances, penalties, and W-2 issues.

-

Payroll Processing Validation Best Practices - Learn which reports to use to validate your payroll before submitting (during Step 3 of the payroll process), and get advice on the post-processing reports we recommend downloading. Validating every payroll will help you stay on top of your tax withholdings.

-

Quarter End Payroll and Tax Validation Guide - Quarter close is an excellent time to check in on your taxes and W-2 wages. We recommend performing our quarter-end payroll and tax validation in the final few weeks of each quarter to ensure your payroll data is in good shape.

UPDATE RATE CHANGES

HOW TO KEEP TAX RATES UP-TO-DATE.

After you've registered and received tax IDs, the state may periodically mail you an adjusted tax rate. When these notices are received, you should go to Company > Tax and adjust your rate.

Note that Namely strongly advises only adding or editing a tax rate when the state agency has provided documentation indicating an increase or decrease in the rate. For more information see Adding and Editing Company Tax Codes and Rates in Namely Payroll.

REVIEW EMPLOYEE INFORMATION

EMPOWER EMPLOYEES TO REVIEW THEIR TAX INFORMATION.

It's important to routinely verify employee tax information on file to ensure that employees are set up with the correct applicable tax rates in Namely. Any time an employee has a change to his or her W4 filing status, make sure that the change is updated in Namely.

We also recommend you share the following resources with your employees to help them access tax documents so they can ensure their personal tax information is up-to-date:

-

Where can I go to see my W-4 and State tax elections? - This FAQ can help your employees review their W-4 exemptions.

-

Keeping Up With Your Tax Withholdings - Help employees perform a Paycheck Checkup to prevent tax issues come W-2 season.

Note that if employees need to make withholding adjustments, currently they cannot initiate updates to withholding via Tax Unification. However, you can send W-4s for them to update via the Manage eSignature tool. See Managing eSignature Documents for detailed instructions.

RESOLVE TAX NOTICES AND VARIANCES

HOW TO ADDRESS TAX ISSUES QUICKLY.

If you have an issue with your tax data, you'll likely receive a tax notice or a tax variance. Both are common occurrences, and Namely is here to help! These articles will help you understand tax notices and variances—learn why you may have received them, how to avoid them, and the next steps you should take to partner with Namely when resolving any notices and variances.

-

Handling Tax Notices - If you receive a tax notice from a jurisdiction, it's important to take action immediately. This article provides best practices for your next steps.

-

Tax Variance Process and Calculations - This primer on tax variances covers root causes for variances and preventative steps you can take to avoid them. Learn how the variance process works at Namely, including instructions for calculating variances.

TROUBLESHOOTING

HOW TO FIX ERRORS AND MAKE CORRECTIONS.

If something else goes wrong with your taxes—no sweat! We've got you covered. Here are some solutions to common issues we've seen:

-

Unable to File Tax Packages: Error Decoder - This guide will help you troubleshoot and resolve tax filing errors.

-

Payroll Corrections - Explore the different ways you can correct your employee year-to-date totals, including Year to Date Adjustments, Voids and Reissues, and corrective actions you can take in your standard payrolls.

-

Understanding the Void and Reissue Process - Get detailed instructions on partnering with Namely on Voids and Reissues.

-

Processing Year to Date Changes - Learn how to partner with Namely on Year-to-Date Adjustments.

-

For additional information on payroll taxes and withholding, our Comply Databasecontains comprehensive guides to federal and state payroll taxes and withholding requirements.